“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hitman.” — RONALD REAGAN

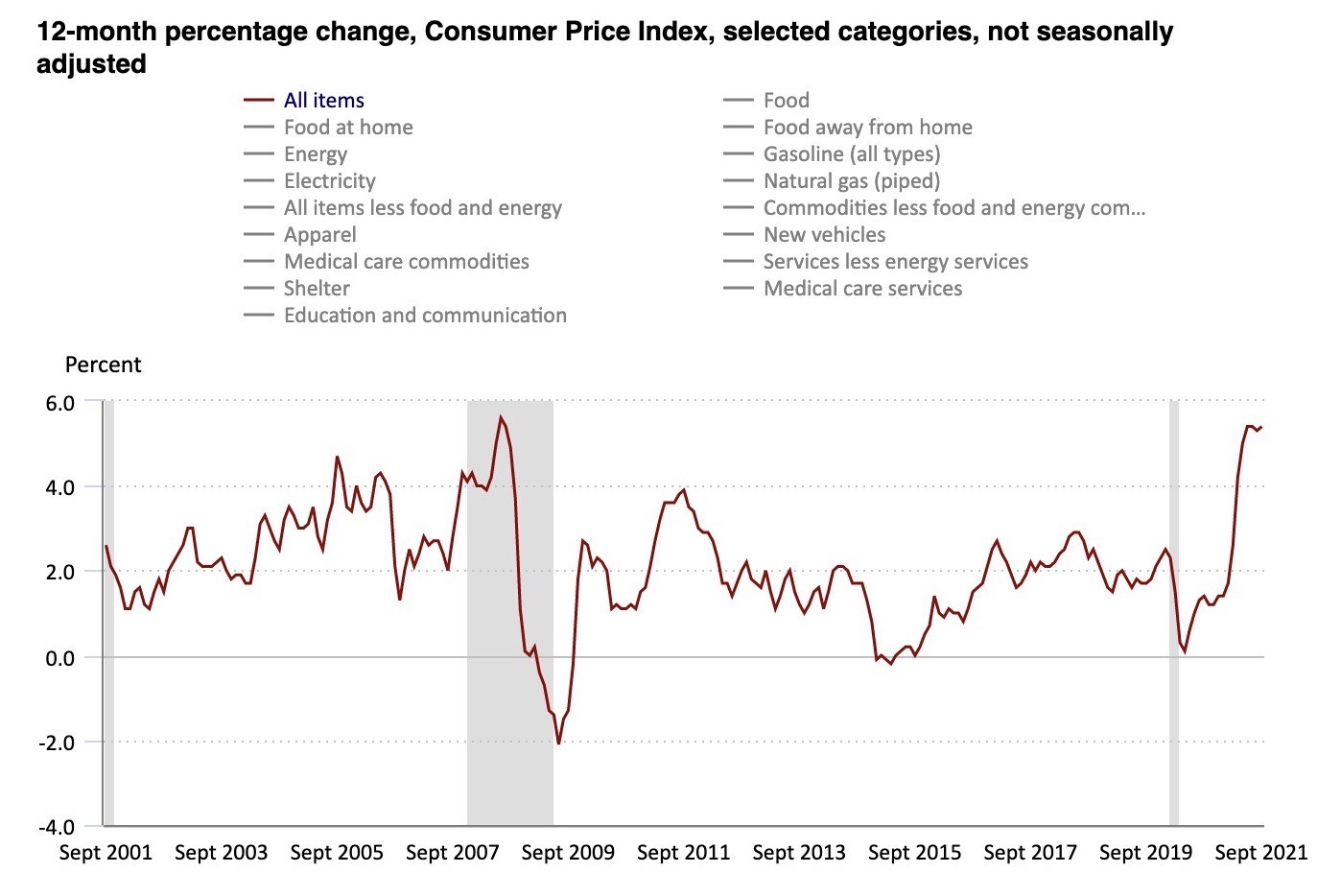

It’s said … inflation is the great transfer of wealth from the uninformed to the informed. OK, let’s get informed. We’ve all sensed that prices have been rising for years … home prices, groceries, energy costs, healthcare, college, cars, property taxes … Now finally, the government’s inflation measure, the Consumer Price Index (CPI), is reflecting what we’ve already known. CPI has risen to 5.4%, the highest since just before the 2008-2009 financial crisis.

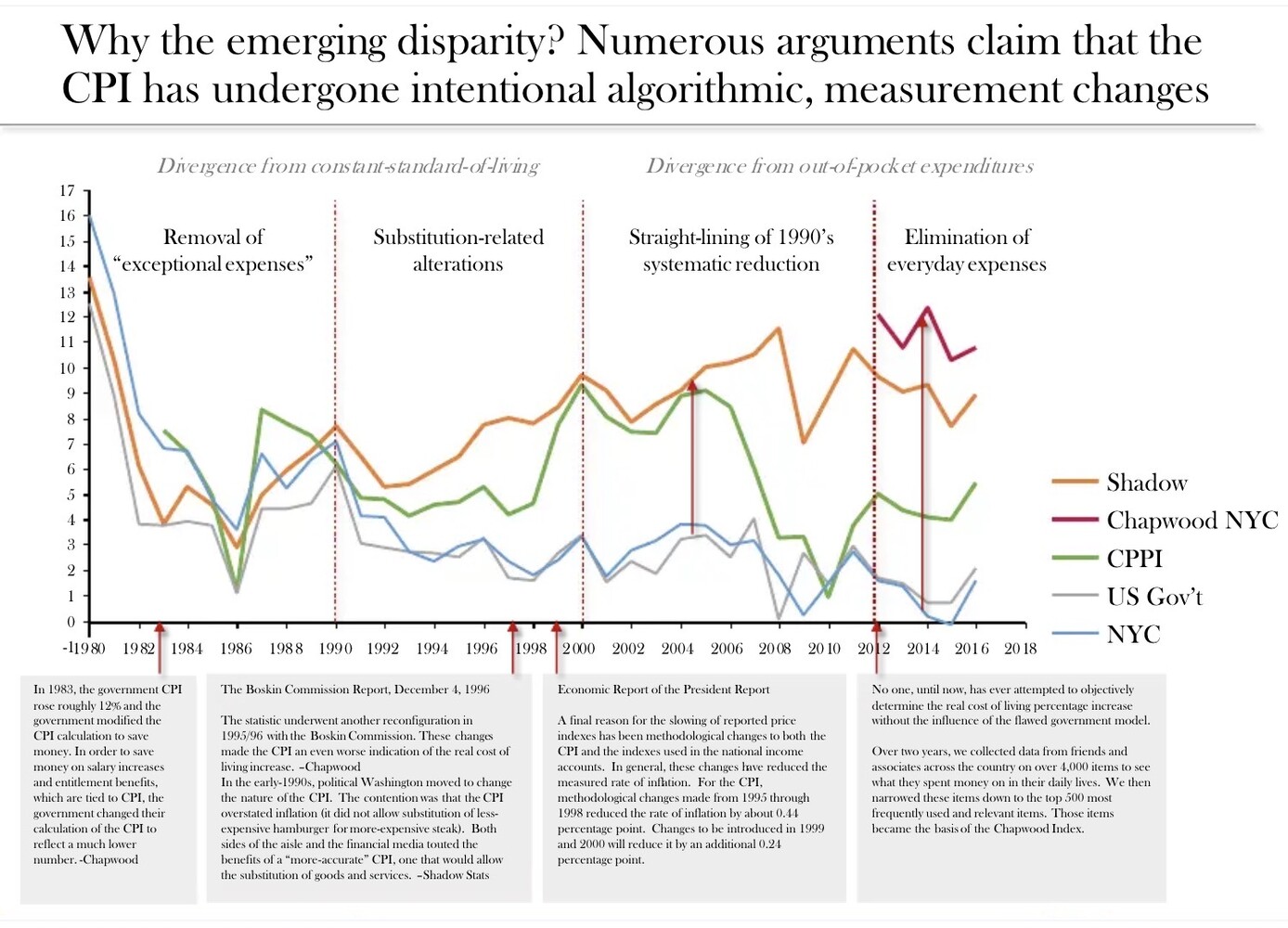

However, inflation isn’t new, it’s just underreported. Federal pension and Social Security cost of living adjustments (COLA) are based on CPI, so the government has been changing the CPI calculation downward to reduce its costs. Among the methods used are:

- substitution – replacing the cost of a steak with the cost of hamburger, or replacing the cost of home ownership with the cost of renting an apartment

- geometric weighting – reducing the weighting of goods when they rise in price

- hedonics – reducing the actual cost of goods based on perceived quality improvements

All this adds up. Using the original CPI calculation, inflation has been around 8%, and has increased to 13%.

Here is a chronology of major changes, alongside the birth of alternative CPI metrics, which attempt to stay true to the original intent of CPI, which was to track inflation.

One of those metrics is the Chapwood Index, which tracks real price changes. Even before this year’s increase in inflation, the 5-year average annual inflation rate for Dallas was 8.9%.

In 2021, inflation has gone from bad to worse. Even government-friendly media like CNN are reporting the effects of inflation … on restaurants, groceries, gas, housing, and travel. As a commercial real estate investor, I see inflation first hand. My partners and I acquired a 108-unit multifamily property in Dallas just last month, and we’re already increasing the rent on new leases by 20%. During a recent on-site visit with a local commercial real estate developer, I was shown a stack of construction quotes with renegotiated prices nearly 50% higher than originally quoted.

Inflation also has a profound impact on our personal finances. When we think of US Treasuries we think “risk-free”, but after inflation they’re losing 8% of their purchasing power, compounded annually. This year the loss will be closer to 13%. Stock market investors who achieve 8-13% average annual returns are just treading water, assuming they avoid the next stock market crash.

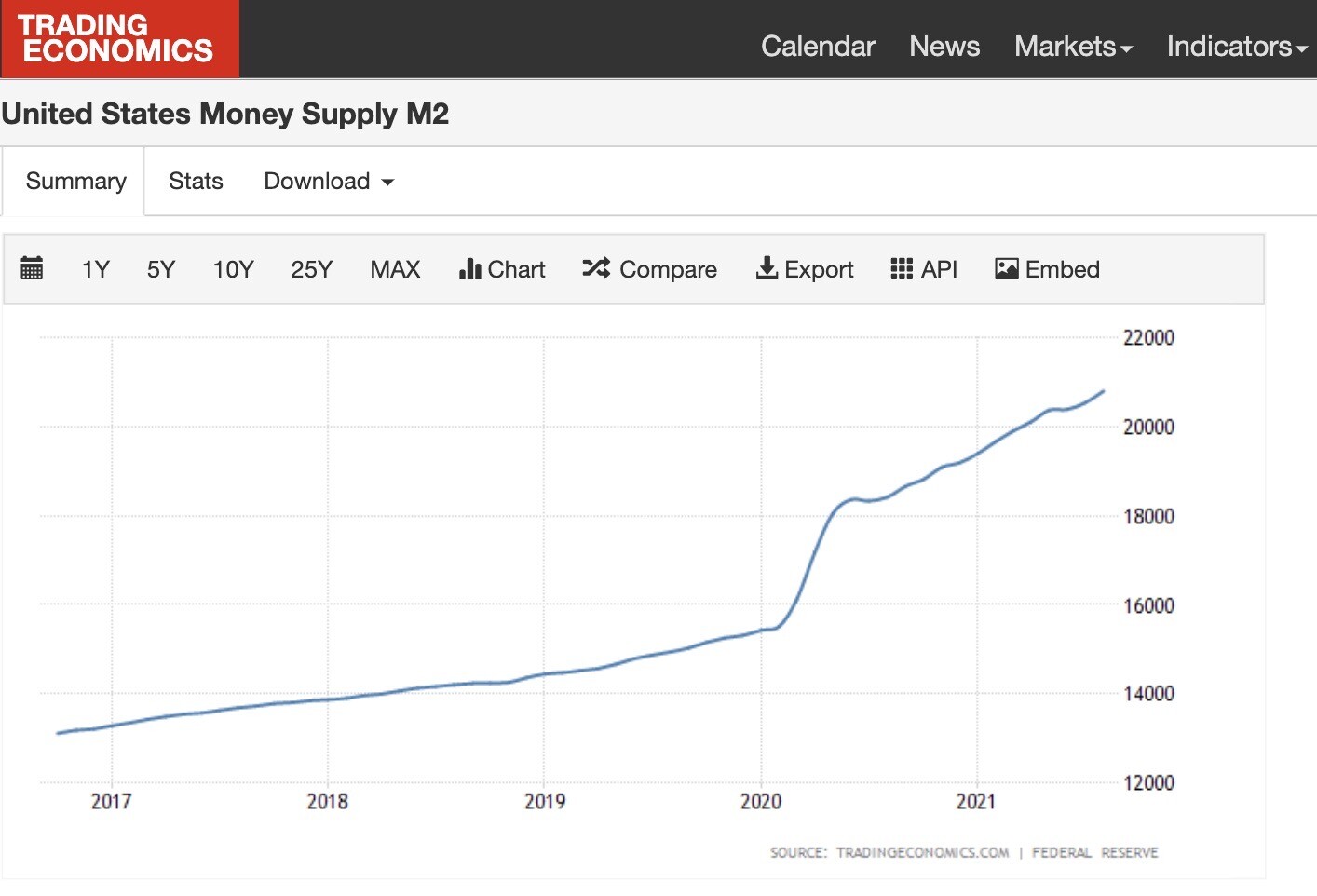

Unfortunately, the situation is likely to get worse. Quantitative Easing is the euphemism for the printing of US Dollars out of thin air to stimulate the economy. This has gone on for years, but the 40% increase in US Dollars printed since early 2020 is breathtaking.

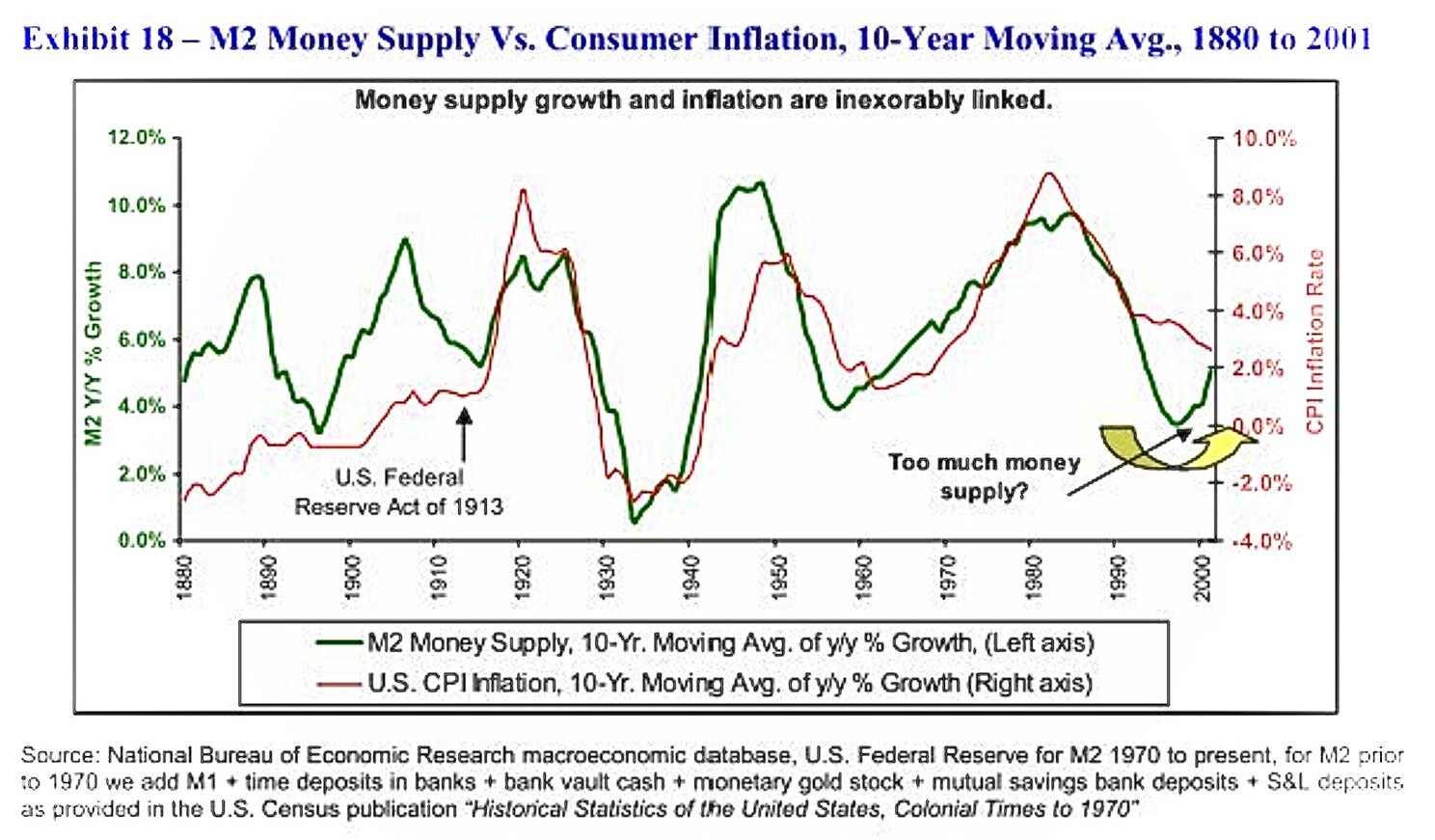

The law of supply and demand tells us that this reduces the value of our money, and this has been proven through history. According to Bannister and Forward (2002, page 28), M2 money supply growth and inflation are inexorably linked.

Since the 1970’s era of high inflation, only twice has the government increased the supply of US Dollars by 10%, during the 2001 dot-com crash and 2008-2009 financial crash. According to Investment Watch:

“The three major crashes of the last 40 years (Black Monday in 1987, Dot Com Bubble Bursting in 2000, and the Lehman Shock in 2008) all had periods of sharply rising inflation just prior to them. The fourth one appears to be happening right now.” — INVESTMENT WATCH

The correlation between the M2 supply of money, inflation rate, and stock market crashes begs the question … would an honest reporting of inflation helped policy-makers prevent these market crashes? Consider this 2007 article exposing the underreporting of inflation. At the time, the actual inflation rate was over 10%. Unfortunately, policy-makers were reporting 5% inflation … just as the 2008-2009 financial crisis loomed undetected.

We entrust policy-makers with protecting us from high inflation and stock market crashes, but it appears policy-makers are only accelerating us toward the next crisis, and just this month both Senator Rand Paul and our own Senator Ted Cruz have sounded the alarm.

In the past, our leaders believed capitalism, not socialism, created prosperity. Perhaps former British Minister Margaret Thatcher said it best:

“The inherent vice of capitalism is the unequal sharing of blessings; the inherent virtue of socialism is the equal sharing of misery.” — MARGARET THATCHER

Today, our policy-makers are promoting socialism and enacting policies similar to Russian communist revolutionary Vladimir Lenin who said:

“The best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens.” — VLADIMIR LENIN

Famed economist John Maynard Keynes observed:

“Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” — JOHN MAYNARD KEYNES

Lenin underestimates us. We’re informed … and know that:

- increasing money supply reduces the value of our money … inflation

- inflation has been higher than reported … and is increasing

- the increase in money supply and inflation are inexorably linked

- the increase in money supply and inflation are linked to stock market corrections

I’ve researched some of the wealthiest investors: Warren Buffett, chairman of Berkshire Hathaway and history’s “greatest investor”; Robert Kiyosaki, author of Rich Dad Poor Dad, the #1 best-selling personal finance book of all time; and Michael Burry, the hedge-fund manager chronicled in the movie, The Big Short, who foresaw and profited from the 2008-2009 financial crisis. Each has sounded the alarm on the stock market.

Jeff Bartlett is based in Southlake, TX and founder of Dragon Prosperity LLC, which brings investors together to acquire real estate assets once out of reach to individual investors. If you want to learn how to …

- Take money off-the-table in the stock market without paying taxes

- Diversify your portfolio with real assets people need

- Receive years of 9%+ cash flow tax-free

- Achieve an outstanding total return-on-investment

- Multiply your returns as today’s ragging inflation increases

… then take action … Schedule a 30-minute Virtual Coffee … and take a Video Tour of our latest project.